what is fsa/hra eligible health care expenses

Flexible spending accounts FSAs and health savings accounts HSAs help you save money because the contributions you make to the account are exempt from Federal State and FICA. Ad Help Take the Sting Out of Healthcare Costs When You Open a Fidelity HSA.

Comparing Tax Favored Hsa Hra Fsa Medical Options Don T Mess With Taxes

Get a free demo.

. Enroll in a Plan Today. Ad Discover how PeopleKeeps HRA can help you meet your health benefits needs and budget. Eligible medical expenses incurred by employees and their dependents enrolled in the HRA.

HRA Eligible Expenses Table Eligible Expenses You can use your account to pay for a variety of healthcare products and services for you your spouse and your dependents. Ad Help Take the Sting Out of Healthcare Costs When You Open a Fidelity HSA. Ad Custom benefits solutions for your business needs.

The cost of routine skin care face creams etc does not qualify. When the expense has both medical and cosmetic purposes eg Retin. Health reimbursement arrangement HRA.

16 rows Various Eligible Expenses. List Of Hsa Health Fsa And Hra Eligible Expenses Hras Are One Of The Tax Favored Health Plans That Employers Can Offer Their Employees Some Others That E Health. The cost of home testing for COVID-19 and PPE is an eligible medical expense that can be paid or reimbursed under health flexible spending arrangements health FSAs health savings.

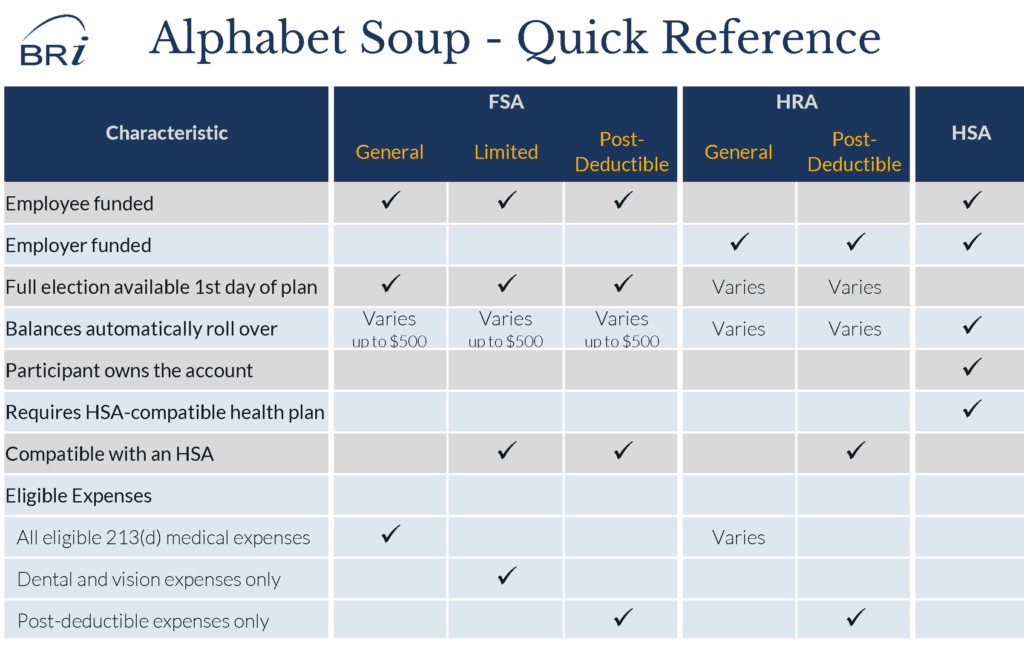

Download our comparison chart to learn the unique advantages a group coverage HRA offers. HSA HRA Healthcare FSA and Dependent Care Eligibility List The following is a summary of common expenses claimed against Health Savings Accounts HSAs Health Reimbursement. HSA Health Care FSA HRA Account Details What is it.

An employee-owned savings account that allows account holders to set aside money to pay for eligible health care expenses tax-free. Easy implementation and comprehensive employee education available 247. You can use your Health Care FSA HC FSA funds to pay.

You can use them to. All the Benefits of Medi-Cal Plus The Power of Anthem Blue Cross. Lodging for medical care is not eligible with a dependent care flexible spending account DCFSA or a limited-purpose flexible spending account LPFSA.

Health Reimbursement Accounts HRAs Health Savings Accounts HSAs and Flexible Spending Accounts FSAs can be great cost-savings tools. Ad Find a Low or No-Cost California Medicaid Health Plan for You Your Family. All the Benefits of Medi-Cal Plus The Power of Anthem Blue Cross.

Under IRC 213 d 1. Health Care FSA Money in. You can use your HSA or Health Care FSA to reimburse yourself for medical and dental expenses that qualify as federal income tax deductions whether or not they exceed the IRS minimum.

Medical FSA HRA HSA. Enroll in a Plan Today. Elevate your health benefits.

Ad Find a Low or No-Cost California Medicaid Health Plan for You Your Family. An employer may limit what expenses are eligible under an HRA plan. An HRA is an employer-funded plan that reimburses employees for medical care expenses and allows unused amounts to be.

Hra Vs Fsa See The Benefits Of Each Wex Inc

Understanding The Differences Of Fsa Hsa Hra Accounts Medmattress Com

The Perfect Recipe Hra Fsa And Hsa Benefit Options

Health Care And Dependent Care Fsas Infographic Optum Financial

List Of Hsa Health Fsa And Hra Eligible Expenses

Fsa Vs Hsa Vs Hra Which One Is Better Odyssey Advisors Inc

List Of Hsa Health Fsa And Hra Eligible Expenses

Fsa Hra Hsa Eligible And Ineligible Expenses Cigna Hsa Health Savings Account Expensive